Overcoming Cultural Barriers in International Joint Venture Partnerships

Imagine the potential of joining forces with partners from different countries, bringing diverse perspectives, resources, and expertise to the table. However, the path to success is not without obstacles. Cultural differences can impact communication, decision-making, work styles, and ultimately the outcomes of your joint venture. In this article, we will delve into the challenges faced in ...

Overcoming Resource Constraints: Strategies for Success in Joint Venture Partnerships

In the world of real estate investment, borrowers and real estate investors often face resource constraints that can hinder their ability to pursue lucrative opportunities. Limited capital, expertise, or networks can pose significant challenges, but they don’t have to be insurmountable obstacles. Joint venture partnerships offer a powerful solution to overcome these resource constraints. By pooling ...

The Art of Compromise: Resolving Conflicts in Joint Venture Partnerships

Joint venture partnerships hold great potential for profitability and growth, but they also come with their fair share of challenges. Miscommunication, differing expectations, financial disagreements, and decision-making conflicts can all create roadblocks along the way. However, by understanding these challenges and implementing effective conflict resolution strategies, you can transform conflicts into opportunities for growth and build ...

Building Robust Agreements: Overcoming Legal Challenges in Joint Venture Partnerships

In the dynamic world of real estate investing and lending, joint venture partnerships can be a powerful tool for success. By pooling resources, expertise, and risks, investors and lenders can unlock new opportunities and maximize returns. However, navigating the legal complexities and potential challenges in joint venture partnerships is crucial for their long-term viability and ...

From Competitors to Collaborators: Transforming Relationships into Joint Venture Partnerships

Are you ab esteemed private lenders and real estate investors and ready to unlock the untapped potential of collaboration and transform your Competitors to Collaborators? In the ever-evolving world of borrowers and real estate investments, building successful partnerships is the key to achieving unparalleled growth and success. In this expert guide, we will reveal the secrets ...

Joint Venture Partnerships: Evaluating Exit Strategies with a Comprehensive Checklist

Joint venture partnerships play a crucial role in the real estate industry, enabling private lenders, real estate investors, and buyers to pool their resources, expertise, and capital for mutual benefits. However, the success and profitability of these partnerships depend on various factors, including the evaluation of exit strategies. An effective exit strategy ensures that investors can ...

Joint Venture Partnerships: A Comprehensive Checklist for Evaluating Market Trends

As a private lender, real estate investor, or buyer, understanding market trends is the key to unlocking lucrative opportunities and mitigating risks. Whether you’re considering residential or commercial properties, evaluating market trends ensures that you invest your time, effort, and capital wisely This checklist is designed to guide you through the process of evaluating market trends ...

The Role of Trust in Joint Venture Partnerships: Essential Checklist for Building Confidence

In the dynamic world of joint venture partnerships, trust stands as a cornerstone for success. Establishing and nurturing trust is paramount to building confidence and ensuring fruitful collaborations. To guide you on this vital journey, we have crafted an essential checklist that outlines the key steps to take in order to foster trust and create ...

Joint Venture Partnerships: Assessing Competencies for Optimal Project Execution

In the realm of real estate investment, successful project execution hinges on the careful assessment of competencies. By evaluating the capabilities of potential partners, you can build collaborations on a solid foundation, ensuring Optimal Project Execution. That’s why we have crafted a comprehensive checklist to guide you through the process of assessing competencies and making informed ...

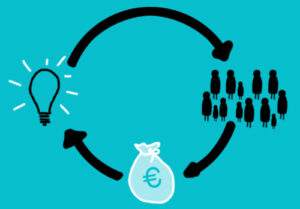

Joint Ventures vs. Crowdfunding: Which is Better for Real Estate Financing?

Real estate investing can be a lucrative way to build long-term wealth, but it often requires significant upfront capital. For many investors, securing financing for their real estate projects can be a challenging obstacle to overcome. Fortunately, there are a variety of financing options available, including joint ventures and crowdfunding. But which is the better option ...