Effortlessly Navigate Legal and Tax Compliance: A Step-by-Step Guide

Are you considering buying, selling, or financing a real estate transaction? If so, it’s important to understand the legal and tax requirements that come with it. Legal and tax compliance is an essential part of any real estate transaction. It involves ensuring that all parties involved in the transaction comply with the relevant laws and regulations. Navigating legal and tax compliance can be a complex and confusing process, but with the right guidance, it can be made easier.

Navigating legal and tax compliance can be a daunting task, but with the right guidance, you can ensure that your transaction is legally binding, enforceable, and compliant with all relevant laws and regulations. In this step-by-step guide, we’ll walk you through everything you need to know about navigating legal and tax compliance in real estate transactions.

From understanding the requirements and gathering necessary documentation to working with professionals and reviewing all documents, we’ve got you covered. So, let’s get started and navigate legal and tax compliance with ease!

The Importance of Legal and Tax Compliance in Real Estate

Legal and tax compliance is crucial in real estate transactions for a number of reasons:

- Compliance with legal and tax requirements helps to ensure that the transaction is legally binding and enforceable.

- Non-compliance can result in costly fines, penalties, and legal disputes.

- Compliance with legal and tax requirements helps to protect the interests of all parties involved in the transaction, including buyers, lenders, and borrowers.

Understanding Legal and Tax Requirements

The first step in navigating legal and tax compliance is to understand the legal and tax requirements that apply to your specific situation. This will depend on a variety of factors, including the type of real estate transaction you are involved in, your location, and the parties involved.

Some of the key legal and tax requirements to consider include:

Licensing Requirements

Depending on your location and the type of real estate transaction, you may need to hold a real estate license or other professional licenses. Make sure you are aware of any licensing requirements that apply to your situation.

If you are a real estate buyer or borrower, it is important to work with licensed professionals, such as real estate agents, loan officers, and attorneys, to ensure that you are in compliance with licensing requirements.

Disclosure Requirements

Real estate transactions often require extensive disclosure of information to all parties involved. Make sure you are aware of any disclosure requirements that apply to your situation.

For example, if you are a real estate seller, you may be required to disclose any known defects or issues with the property. If you are a real estate buyer, you may be required to disclose your financial situation or other relevant information to the seller.

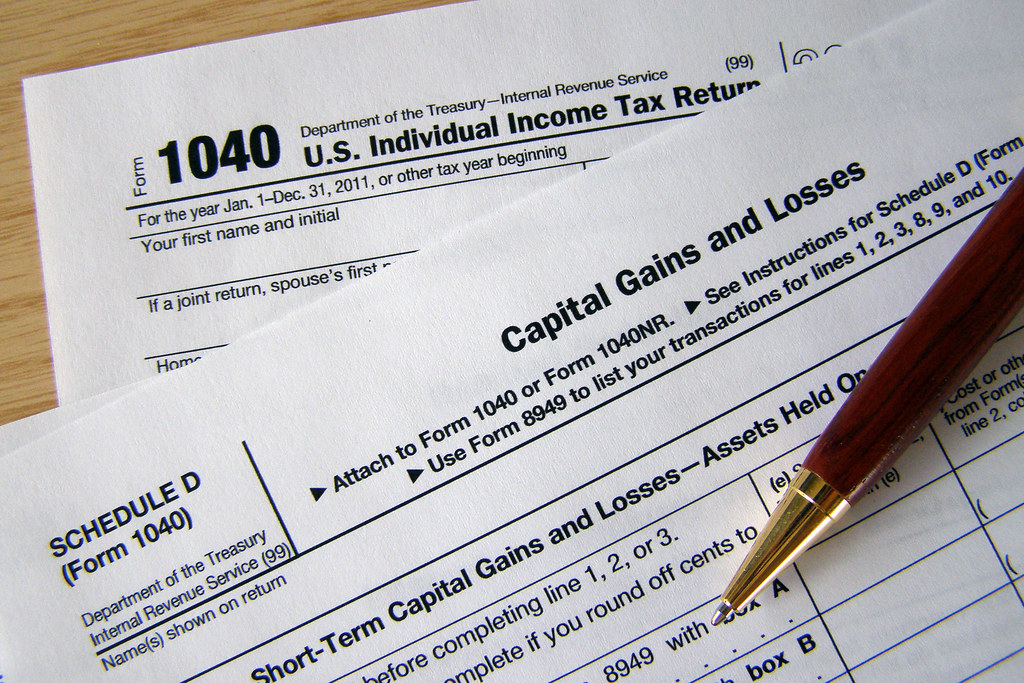

Tax Requirements

Real estate transactions can have significant tax implications, including property taxes, capital gains taxes, and transfer taxes. Make sure you understand the tax requirements that apply to your situation and consult with a tax professional if needed.

For example, if you are a real estate buyer, you may be responsible for paying property taxes on the property. If you are a real estate seller, you may be responsible for paying capital gains taxes on the sale of the property.

Contract Requirements

Real estate transactions are typically governed by a contract that outlines the terms and conditions of the transaction. Make sure you understand the contract requirements that apply to your situation and consult with an attorney if needed.

The contract may include provisions related to the sale price, financing, contingencies, and other important details. It is important to fully understand all of the terms and conditions of the contract before signing.

Gathering Necessary Information and Documentation

Once you understand the legal and tax requirements that apply to your situation, the next step is to gather the necessary information and documentation. This may include:

Identification Documents

You will need to provide identification documents, such as driver’s licenses or passports, to establish your identity and comply with anti-money laundering laws.

Proof of Income and Employment

If you are a real estate borrower, you will need to provide proof of income and employment to demonstrate your ability to repay the loan. This may include pay stubs, tax returns, or other financial documents.

Property Documents

If you are a real estate buyer or seller, you will need to provide property documents, such as deeds or titles, to establish ownership of the property.

Financial Documents

If you are a real estate borrower, you will need to provide financial documents, such as bank statements or loan applications, to demonstrate your creditworthiness and ability to repay the loan.

Contract Documents

If you are a real estate buyer or seller, you will need to review and sign contract documents, such as purchase agreements or lease agreements, to formalize the transaction.

Working with Professionals

Navigating legal and tax compliance can be complex and time-consuming, so it is important to work with professionals who can help guide you through the process. This may include:

Real Estate Agents or Brokers

Real estate agents or brokers can help you find properties that meet your needs and negotiate the terms of the transaction. They can also provide guidance on legal and tax compliance requirements.

Attorneys

Attorneys can provide legal advice and guidance on contract documents and other legal requirements related to real estate transactions. They can also help resolve disputes and protect your legal interests.

Accountants or Tax Professionals

Accountants or tax professionals can provide guidance on tax requirements related to real estate transactions, including property taxes and capital gains taxes. They can also help you minimize your tax liability and maximize your financial benefits.

Loan Officers or Mortgage Brokers

Loan officers or mortgage brokers can help you navigate the financing process and ensure that you are in compliance with lending requirements.

Reviewing and Understanding All Documents

Before signing any documents related to your real estate transaction, make sure you review and understand all of the terms and conditions. This includes contracts, disclosures, loan documents, and any other legal or tax-related documents.

If you have any questions or concerns, don’t be afraid to ask your real estate agent, attorney, or other professionals for clarification. It is important to fully understand all of the documents you are signing to ensure that you are in compliance with all legal and tax requirements.

Staying Up-to-Date on Changes in the Law and Tax Code

The legal and tax requirements related to real estate transactions can change over time, so it is important to stay up-to-date on any changes in the law and tax code that may affect your situation. This may include changes to licensing requirements, disclosure requirements, or tax rates.

Make sure you stay informed about any changes that may affect your real estate transaction by consulting with professionals, reading industry publications, and staying up-to-date on local and national news.

The Benefits of Navigating Legal and Tax Compliance

By following these steps and navigating legal and tax compliance with confidence, you can:

- Ensure that you are in compliance with all legal and tax requirements

- Avoid costly penalties and fines

- Reduce your risk of legal disputes or other issues

- Protect your investment in real estate

By taking the time to navigate legal and tax compliance, you can help ensure a successful and stress-free real estate transaction.

Examples

Here are a few examples of how navigating legal and tax compliance can be useful in real estate transactions:

Real Estate Buyer

A real estate buyer may need to navigate legal and tax compliance by understanding the disclosure requirements for the property they are interested in. They may need to obtain a property inspection to identify any defects or issues with the property and ensure that these are properly disclosed to all parties involved. They may also need to understand the tax implications of owning the property, including property taxes and any potential capital gains taxes when they eventually sell the property.

Real Estate Lender

A real estate lender may need to navigate legal and tax compliance by ensuring that all borrowers meet the lending requirements, such as creditworthiness and income verification. They may also need to ensure that the property being financed meets all legal and tax requirements, such as proper zoning and compliance with building codes.

Real Estate Seller

A real estate seller may need to navigate legal and tax compliance by understanding the disclosure requirements for the property they are selling. They may need to disclose any known defects or issues with the property to potential buyers. They may also need to understand the tax implications of selling the property, including potential capital gains taxes.

Final Words

Navigating legal and tax compliance is a critical part of any real estate transaction, but it doesn’t have to be overwhelming. By understanding the legal and tax requirements, gathering the necessary information and documentation, working with professionals, reviewing and understanding all documents, and staying up-to-date on changes in the law and tax code, you can navigate this process with confidence and ensure a successful real estate transaction.

Remember, legal and tax compliance is essential for protecting your interests and avoiding costly penalties and fines. By following these steps, you can ensure that your real estate transaction is legally binding and enforceable, and that you are in compliance with all relevant laws and regulations.