Finance Contracts Audit: Time-Saving Tips for Hassle-Free Reviews

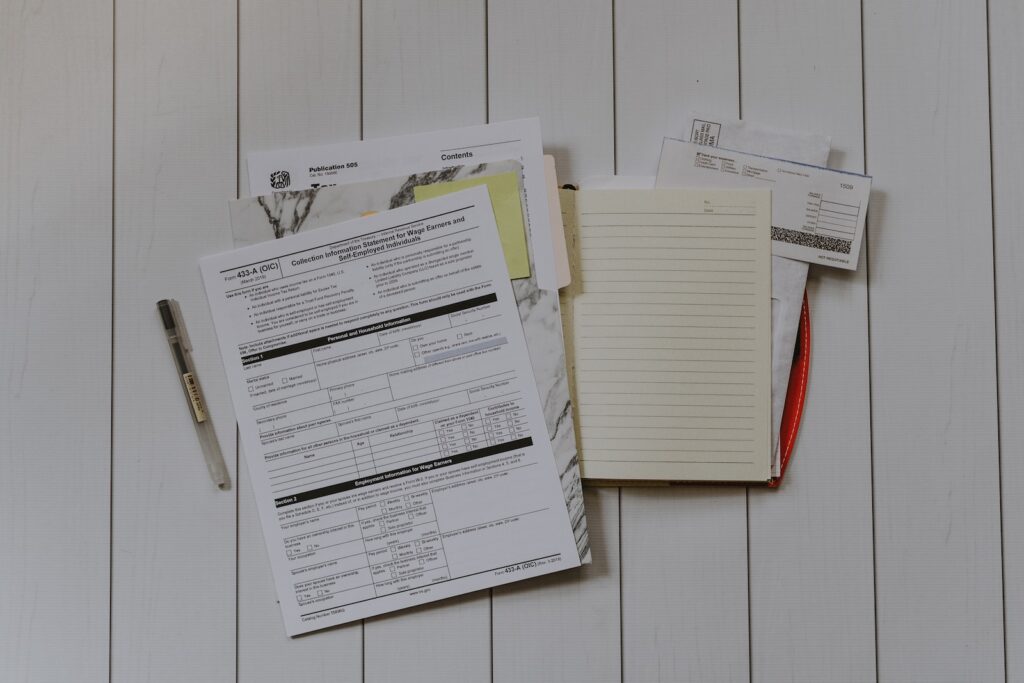

Welcome, private lenders, real estate investors, and buyers! In this article, we’ll equip you with practical and effective problem-solving strategies to master finance contract audits efficiently. We understand the importance of saving time while ensuring thorough reviews, so you can make well-informed financial decisions.

From creating an efficient audit checklist to leveraging technology and conducting thorough due diligence, we’ll cover essential steps and examples to guide you.

Let’s dive in and explore the secrets to hassle-free finance contract audits. Get ready to take control of your review process and unlock the potential for more successful financial outcomes.

Understanding Finance Contracts: A Foundation for Effective Audits

Before delving into the audit process, it is essential to establish a solid foundation by understanding finance contracts and their key components. Finance contracts are legally binding agreements that detail the terms and conditions of a financial transaction.

These contracts are widely used in real estate deals, loans, and investment partnerships. To conduct a thorough audit, familiarize yourself with the language used in contracts, the significance of various clauses, and industry-standard terms.

Practical Problem-Solving Strategies for Finance Contracts Audit

1. Create an Efficient Audit Checklist

A well-structured and comprehensive checklist is your compass during finance contract audits. It serves as a guide, ensuring you cover all critical review points without overlooking essential details.

Your checklist should include sections such as interest rates, payment schedules, penalties, collateral details, dispute resolution mechanisms, and any other pertinent aspects specific to your contracts. Having a checklist in place not only saves time but also provides clarity and consistency in your review process.

2. Leverage Technology for Smart Reviews

In the digital era, technology can be a powerful ally in conducting efficient audits. Consider utilizing contract management software with automation features.

These cutting-edge tools can analyze and extract vital data from contracts swiftly, reducing the burden of manual data entry and minimizing the risk of human error. Automation streamlines the review process, allowing you to focus on interpreting the extracted data and identifying potential issues.

3. Conduct Thorough Due Diligence

Due diligence is a critical step in finance contract audits, enabling you to assess the credibility, track record, and financial stability of all parties involved in the contract.

Research and verify the background of your counter parties, gather information on their reputation, and analyze their past performance. Thorough due diligence empowers you to make informed decisions, safeguard your interests, and mitigate potential risks.

4. Seek Legal Expertise

Finance contracts often involve complex legal language and intricate clauses. Engage the services of a qualified attorney who specializes in finance contracts to review the documents thoroughly.

A legal expert can provide valuable insights, flag potential issues, and ensure compliance with relevant regulations. Their expertise will bolster your confidence in handling complex contracts.

5. Embrace Continuous Learning

Finance contracts and regulations evolve over time. To stay ahead in your field, commit to continuous learning. Attend industry seminars, webinars, and workshops to keep yourself updated with the latest trends and legal developments in finance contracts.

Continuous learning enhances your problem-solving skills and ensures you remain well-informed in an ever-changing financial world.

Examples Illustrating the Strategies:

- Example 1: Automated Data Extraction

- An esteemed real estate investor utilizes contract management software with automated data extraction capabilities. The software efficiently scans mortgage agreements and extracts crucial data such as interest rates, payment terms, and significant dates. This automation saves valuable hours, which can be redirected towards higher-value tasks, such as data analysis and strategy formulation.

- Example 2: Identifying Hidden Penalties

- A prominent private lender diligently follows their audit checklist while reviewing a loan agreement. During this review, they identify hidden penalty clauses buried in the contract. Armed with this knowledge, the lender initiates renegotiation with the borrower, ensuring a more favorable deal and protecting their financial interests.

- Example 3: Informed Investment Decision

- A valued buyer conducts extensive due diligence on a property seller. Through thorough research, they unearth past disputes involving the seller. Armed with this critical information, the buyer negotiates a better deal, avoiding potential legal complications and making an informed investment decision.

Benefits of Adopting These Problem-Solving Strategies

Implementing these problem-solving strategies for finance contract audits offers numerous benefits that elevate your proficiency and confidence in handling contracts:

- Time Savings: Streamlined processes and automation reduce the time spent on reviews, allowing you to focus on other critical tasks and seize new opportunities.

- Improved Accuracy: Leveraging technology for data extraction and analysis minimizes the risk of human error, ensuring your assessments are reliable and precise.

- Risk Mitigation: Thorough due diligence and legal expertise help you identify potential risks, empowering you to make more informed and secure financial decisions.

- Confidence in Negotiations: Mastering contract knowledge and having a comprehensive checklist enhances your negotiation power, enabling you to secure more favorable terms.

- Continual Growth: Embracing continuous learning ensures you stay updated with industry trends and changes, making you a well-informed and agile financial professional.

Resources and Tools to Implement the Strategies

Embarking on a journey to improve your finance contract audits requires access to valuable resources and tools. Here are some recommendations to aid you in implementing these problem-solving strategies:

- Contract Management Software: Explore reputable contract management solutions like XYZ ContractPro to automate data extraction and streamline your contract reviews.

- Online Legal Databases: Access legal databases such as ABC LegalHub to stay updated on contract laws, regulations, and best practices.

- Industry Webinars: Attend webinars hosted by finance and real estate experts to gain valuable insights into the latest trends and best practices.

- Professional Networking: Engage in professional networks and forums to collaborate with peers, share insights, and learn from their experiences.

Collaboration and Sharing: A Path to Collective Growth

We believe in the power of collaboration and knowledge sharing within our esteemed community. As you embark on your journey to master finance contract audits, we encourage you to share your own tried-and-tested problem-solving strategies in the comments below.

Let’s learn from each other and collectively enhance our audit processes. Together, we can achieve greater heights of success and excellence.

As we conclude this enlightening exploration of finance contract audits, we leave you with a thought-provoking question: How have your problem-solving strategies positively impacted your investment decisions?

Share your experiences and insights, and let’s inspire others to take control of their financial future. Together, we can build a community that thrives on knowledge, growth, and success.