Real Estate Tax Strategies: Advantages of Financial Planning Training

Financial Planning Training equips individuals with comprehensive knowledge and skills to manage their financial resources wisely and efficiently. It involves evaluating one’s financial situation, setting realistic goals, and making informed decisions to achieve those goals.

When these two elements, Real Estate Tax Strategies and Financial Planning Training, are brought together, they form a potent tool set for private lenders and real estate investors to navigate the complex world of real estate taxation and make strategic financial decisions.

In this article, we will explore the numerous benefits and advantages of this training and why it is crucial for anyone looking to thrive in the real estate industry. So, let’s dive into this transformative realm of knowledge and expertise.

Understanding Financial Planning Training

Real Estate Tax Strategies are essential techniques used to optimize tax outcomes for real estate investments. The goal is to minimize tax liabilities legally while maximizing profits. These strategies include deductions, credits, and incentives specifically tailored for the real estate domain.

On the other hand, Financial Planning Training equips you with comprehensive knowledge and expertise in managing your financial resources wisely and efficiently.

When you combine Real Estate Tax Strategies with Financial Planning Training, you gain a powerful tool set that can lead you towards financial success in the real estate world.

By mastering the intricacies of tax laws and financial planning, you can make informed financial decisions, optimize your investment returns, stay compliant with regulations, and avoid costly mistakes.

The Purpose and Function

The primary purpose of Real Estate Tax Strategies and Financial Planning Training is to empower you with the necessary tools to make informed financial decisions in the real estate industry. Let’s break down the functions of each component:

Real Estate Tax Strategies: The function of Real Estate Tax Strategies is to provide you with a deep understanding of tax laws related to real estate. You will learn about various deductions, credits, and incentives available to real estate investors, helping you structure your investments in a tax-efficient manner.

Financial Planning Training: The function of Financial Planning Training is to equip you with the skills to manage your finances effectively.

You will learn how to evaluate your financial situation, set realistic financial goals, and create a comprehensive financial plan to achieve those goals. This training ensures you make wise financial decisions throughout your real estate journey.

Together, Real Estate Tax Strategies and Financial Planning Training provide a holistic approach to managing your finances and taxes in the real estate world.

Key Benefits and Advantages

Now, let’s explore the key benefits and advantages of enrolling in Real Estate Tax Strategies and Financial Planning Training:

1. Empower Your Financial Decision-Making: The training provides you with the knowledge and skills to assess your financial situation accurately. By understanding your financial strengths and weaknesses, you can make informed decisions about real estate investments that align with your financial goals.

- Example:

- After receiving Financial Planning Training, John, a seasoned Real Estate Investor, identified tax-saving opportunities in his portfolio, leading to a significant increase in his overall returns.

2. Master Real Estate Tax Strategies: By learning about Real Estate Tax Strategies, you can optimize your investment returns by taking advantage of available tax deductions and credits. This knowledge allows you to structure your investments in a way that minimizes tax liabilities, ultimately leading to higher profits.

- Example:

- Sarah, a Private Lender, used her knowledge of Real Estate Tax Strategies to make strategic adjustments to her real estate holdings, resulting in substantial tax savings.

3. Stay Compliant and Avoid Pitfalls: Real estate taxation can be complex and subject to frequent changes. Financial Planning Training ensures you stay updated with tax regulations, helping you avoid costly mistakes and potential penalties.

- Example:

- Michael, a Real Estate Buyer, attended a Financial Planning Training, which enabled him to accurately report his investment income, eliminating the risk of penalties.

4. Optimize Your Return on Investment (ROI): A well-executed tax strategy can significantly impact your bottom line. With the knowledge gained from training, you can implement tax-saving techniques that enhance your ROI and improve overall profitability.

- Example:

- Emily, a Real Estate Investor, implemented advanced tax strategies she learned in her training, resulting in a substantial boost to her cash flow and net worth.

5. Mitigate Risks: Financial Planning Training equips you with risk management skills. You’ll learn how to diversify your investments and create contingency plans, safeguarding your financial interests in uncertain times.

- Example:

- Jason, a Real Estate Investor, applied risk management strategies learned in the training to protect his investments during a market downturn, preserving his wealth.

6. Long-Term Wealth Building: Financial Planning Training emphasizes the importance of disciplined savings and investments. By creating a solid financial plan, you’ll be on the path to long-term wealth building and financial security.

- Example:

- Lisa, a Real Estate Investor, diligently followed her financial plan after training, which helped her achieve her financial goals, including early retirement.

Unique Selling Points and Differentiators

a) Specialized Real Estate Focus: Our training program is exclusively tailored to cater to the unique tax challenges and opportunities in the real estate domain. We understand the complexities of real estate taxation and address them comprehensively.

b) Expert Faculty: Our training is led by seasoned financial and real estate experts with a proven track record of success. You’ll receive top-notch education from professionals who understand the industry inside out.

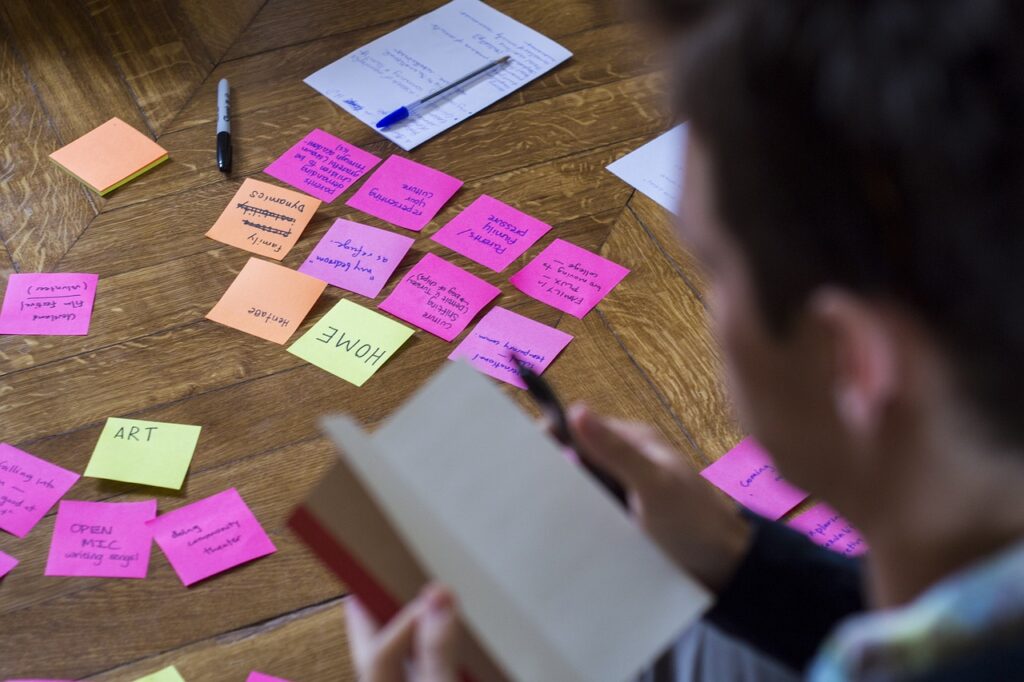

c) Interactive Learning: We believe in hands-on learning experiences. Our training includes interactive exercises, case studies, and practical scenarios that simulate real-life tax situations. This approach fosters a deeper understanding of the concepts and their application.

d) Ongoing Support: Beyond the training, we provide ongoing support to our participants. Our team of experts is available to answer your queries and offer guidance as you implement your tax strategies and financial plan.

Testimonials and Success Stories

“The Real Estate Tax Strategies and Financial Planning Training provided me with invaluable insights. I applied the strategies immediately and saw a noticeable increase in my after-tax profits. Highly recommended!” – Robert, Real Estate Investor

“As a Private Lender, I wanted to optimize my investments. This training helped me identify tax advantages that I wasn’t aware of before. It’s a game-changer!” – Samantha, Private Lender

Final Words

Congratulations! You now understand the immense value that Real Estate Tax Strategies and Financial Planning Training can bring to your real estate ventures. Don’t miss this opportunity to empower yourself with the knowledge and skills necessary to navigate the tax landscape confidently. Take charge of your financial future today!

As you embark on this transformative journey, challenge yourself with this question: “How will mastering Real Estate Tax Strategies and Financial Planning impact my overall financial well-being and open doors to new investment opportunities?” Embrace the challenge and unlock your full potential!

Real Estate Tax Strategies for International Investors

If you’re an international investor looking to explore real estate opportunities in different countries, our specialized training covers tax implications for cross-border investments. Expand your horizons and gain the knowledge needed to navigate global tax landscapes with ease.

Taking Your Investments to the Next Level

For experienced investors seeking to maximize their returns and unlock advanced tax-saving techniques, our advanced training offers in-depth strategies tailored to seasoned professionals. Elevate your real estate investment game and reap the rewards of sophisticated tax planning.