The Lender’s Checklist for a Smooth Real Estate Transaction

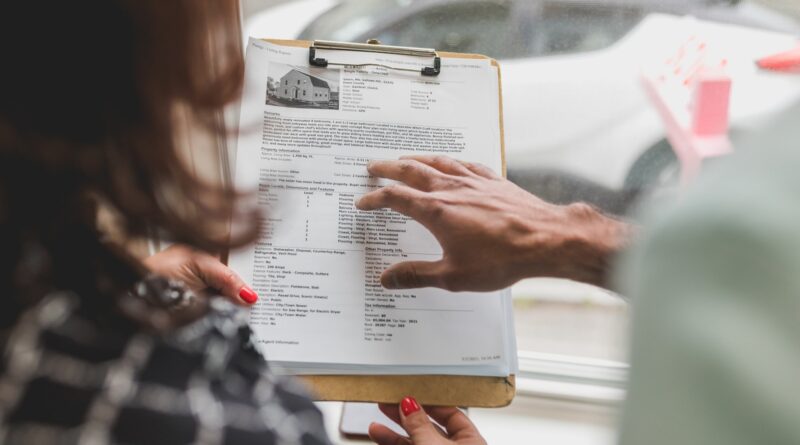

Real estate investing is a lucrative business that can offer great rewards, but it is not without its challenges. Whether you are a lender, borrower, or real estate investor, a successful transaction is always the goal. However, with so many moving parts and potential pitfalls, it can be easy to miss an important step and end up with a failed deal. That is why having a solid checklist to guide you through the process is essential.

In this article, we will provide a comprehensive guide to The Lender’s Checklist for a Smooth Real Estate Transaction. We’ll break down each step of the process, explaining why it’s important and what you need to do to complete it successfully. By the end of this article, you will have a clear understanding of the steps you need to take to ensure that your real estate transactions are successful and that your investment is protected.

Whether you are a seasoned real estate investor or a first-time home buyer, this checklist will help you stay organized and on track. It will also help you navigate the complex process of real estate transactions with ease and confidence. So let’s dive in and take a closer look at The Lender’s Checklist for a Smooth Real Estate Transaction.

Why You Need a Checklist?

The real estate transaction process is complex, involving a lot of paperwork, legal documents, and due diligence. It’s easy to overlook something important if you don’t have a clear plan in place. Additionally, having a checklist helps you stay organized and on track, which can save you time and money in the long run. Finally, a checklist can help you mitigate risk by ensuring that all necessary due diligence is performed and that you’re making informed investment decisions. Overall, a checklist is an essential tool to help you navigate the real estate transaction process with confidence.

The Checklist

Here are the specific steps that you need to take to ensure a smooth real estate transaction:

- Perform due diligence on the property.

Before you invest in a property, you need to perform due diligence to ensure that it’s a good investment. This includes researching the property’s history, zoning laws, and any outstanding liens or other legal issues. You should also have the property inspected by a professional to identify any potential problems that could impact your investment. Here are some specific actions you can take:

- Research the property’s history, including previous owners, sales history, and any liens or encumbrances on the property.

- Research the local zoning laws and any upcoming developments that could impact the property.

- Have the property inspected by a professional to identify any potential problems, such as structural issues or problems with the HVAC system.

- Review the purchase contract.

Once you’ve decided to invest in a property, you’ll need to review and sign a purchase contract. It’s important to carefully review the contract to ensure that it includes all necessary terms and conditions, and that it protects your investment. Here are some specific actions you can take:

- Read the entire purchase contract, including any addenda or amendments.

- Ensure that the purchase price and terms of the agreement are accurately reflected in the contract.

- Ensure that the contract includes all necessary contingencies, such as financing and inspection contingencies.

- Ensure that the contract includes any necessary disclosures, such as lead paint disclosures.

- Have an attorney review the contract to ensure that it protects your investment and interests.

- Secure financing.

Unless you’re paying cash for the property, you’ll need to secure financing. It’s important to shop around and compare rates and terms from multiple lenders to ensure that you’re getting the best deal. Here are some specific actions you can take:

- Research different types of loans, such as fixed-rate and adjustable-rate mortgages.

- Compare rates and terms from multiple lenders to find the best deal.

- Review the terms of the loan, including the interest rate, points, and fees.

- Ensure that the loan meets your financial goals and budget.

- Provide all necessary documentation to the lender, such as tax returns and bank statements.

- Review and sign loan documents.

Once you’ve secured financing, you’ll need to review and sign loan documents. It’s important to carefully review these documents to ensure that they accurately reflect the terms and conditions of your loan. Here are some specific actions you can take:

- Read the entire loan agreement, including any addenda or amendments.

- Ensure that the terms of the loan are accurately reflected in the documents.

- Ensure that the documents include all necessary disclosures, such as Truth in Lending and RESPA disclosures.

- Ask any questions you may have about the loan or the documents.

- Sign the documents and provide any necessary funds.

- Review title insurance.

Title insurance protects you from any issues related to the property’s title, such as liens or other legal issues. It’s important to carefully review your title insurance policy to ensure that you’re adequately protected. Here are some specific actions you can take:

- Review the title insurance policy to ensure that it covers any potential title issues.

- Ensure that the policy reflects the correct ownership and other details about the property.

- Ask any questions you may have about the policy or the coverage.

- Purchase any additional endorsements or coverage that may be necessary.

- Close the transaction.

Once all necessary due diligence has been performed and all documents have been signed, it’s time to close the transaction. This typically involves transferring ownership of the property and paying any necessary fees and taxes. Here are some specific actions you can take:

- Review the settlement statement to ensure that all fees and taxes are accurate.

- Ensure that all necessary documents are signed and funds are provided.

- Transfer ownership of the property.

- Pay any necessary fees and taxes.

Action Steps

To ensure that you’re following the checklist, here are the action steps you should take:

- Research the property thoroughly, including its history and any legal issues.

- Carefully review and sign the purchase contract.

- Shop around for the best financing deal.

- Carefully review and sign all loan documents.

- Review your title insurance policy.

- Close the transaction.

Examples

Here are some examples of how following this checklist can lead to a successful real estate transaction:

- Example 1:

- John is a lender who is considering investing in a commercial property. Before he makes any decisions, he performs due diligence on the property to ensure that it’s a good investment. He researches the property’s history and zoning laws, and has it inspected by a professional. He then reviews and signs the purchase contract, secures financing, and carefully reviews and signs all loan documents. Finally, he reviews his title insurance policy and closes the transaction. Thanks to his thorough checklist, John is able to invest in the property with confidence, knowing that he’s taken all necessary steps to protect his investment.

- Example 2:

- Sarah is a borrower who is looking to purchase her first home. She’s excited about the prospect of home ownership, but she’s also nervous about the process. To ensure a smooth transaction, Sarah creates a checklist based on the steps outlined in this article. She researches the property thoroughly, carefully reviews and signs the purchase contract, and shops around for the best financing deal. She then reviews and signs all loan documents and title insurance policies, and finally closes the transaction. Thanks to her checklist, Sarah is able to navigate the complex process of purchasing a home with ease, and she feels confident that she’s made a sound investment.

- Example 3:

- Mike is a lender who has been in the real estate business for many years. He’s seen his fair share of successful transactions, as well as some that have gone awry. To ensure that he’s always taking the necessary steps to protect his investments, Mike uses a checklist for every transaction. This checklist includes all of the steps outlined in this article, as well as additional steps that he’s added based on his years of experience. Thanks to his thorough checklist, Mike is able to mitigate risk and ensure successful transactions time and time again.

Final Words

Investing in real estate can be a complex process, but by following this checklist, you can navigate it with ease and confidence. Remember to perform due diligence on the property, carefully review and sign the purchase contract and loan documents, shop around for the best financing deal, review your title insurance policy, and close the transaction. By taking these steps, you can ensure that your investment is protected and that your real estate transactions are successful.

Are you a real estate investor, borrower, or lender? What steps do you take to ensure a smooth transaction? Share your tips and tricks in the comments below!