Crowd Funding Investor Education Checklist: Enhancing Financial Literacy for Real Estate

Are you ready to level up your financial literacy and unlock the potential of real estate investments through crowd funding? Look no further. In this expertly crafted article, we present you with an invaluable checklist designed to guide you through the world of crowd funding investor education, empowering you to make informed decisions and maximize your returns in the dynamic real estate market.

Whether you’re a seasoned investor looking to expand your portfolio or a newcomer eager to tap into the lucrative world of real estate, this checklist is tailor-made for you. We’ll break down the complex process into manageable steps, providing you with clear instructions and insider tips to navigate the crowd funding landscape with confidence and finesse.

With our guidance, you’ll be equipped with the knowledge and tools necessary to seize lucrative investment opportunities and grow your wealth in the ever-evolving real estate industry.

Who is this Checklist for?

This checklist is specifically designed for private lenders and real estate investors who are looking to explore crowd funding as a means to enhance their financial literacy and expand their investment opportunities in the real estate sector. Whether you’re new to crowd funding or seeking to deepen your understanding, this checklist will serve as a valuable resource to navigate the intricacies of crowd funding for real estate.

Breaking Down the Crowd Funding Investor Education Checklist

Let’s dive into the detailed breakdown of the crowd funding investor education checklist:

Evaluate Your Investment Goals and Risk Tolerance

Begin by clearly defining your investment objectives and assessing your risk tolerance. This step is crucial as it will shape your investment strategy and guide your decision-making throughout the crowd funding process. Consider factors such as desired returns, investment time horizon, and acceptable level of risk.

Research Crowd Funding Platforms

Conduct thorough research on different crowd funding platforms that specialize in real estate investments. Look for platforms with a strong track record, transparent fee structures, and a diverse range of investment opportunities.

Consider factors such as the platform’s reputation, regulatory compliance, investor protection measures, and user reviews.

Analyze Investment Opportunities

Once you’ve identified potential crowd funding platforms, carefully analyze the available investment opportunities. Evaluate the property types, locations, financial projections, and risk factors associated with each opportunity.

Consider the track record and expertise of the project sponsors or developers. Assess whether the investment aligns with your investment goals and risk profile.

Perform Due Diligence

Before committing to any crowd funding investment, perform thorough due diligence on the project sponsor or developer. Research their background, experience, and past performance.

Review the legal documentation provided by the sponsor, such as offering memorandums, financial statements, and project plans. Seek professional advice if necessary to ensure you have a comprehensive understanding of the investment opportunity.

Understand Deal Structures

Gain a clear understanding of the deal structures offered by the crowd funding platform. Different investment opportunities may involve various structures, such as equity investments, debt investments, or hybrid models.

Familiarize yourself with the terms and conditions, including the potential returns, voting rights, and exit options associated with each structure.

Assess Investor Protection Measures

Investor protection is a critical aspect of crowd funding. Evaluate the investor protection measures provided by the crowd funding platform.

These measures may include escrow services, guarantees, insurance policies, or legal safeguards. Ensure that the platform has mechanisms in place to protect your investment and mitigate potential risks.

Review Terms and Conditions

Thoroughly review the terms and conditions associated with each investment opportunity. Pay close attention to the expected duration of the investment, any potential exit restrictions, and the rights and responsibilities of investors.

Understand the fees and charges involved, including any management fees or performance-based fees. Seek clarification on any ambiguous or unclear terms to avoid misunderstandings.

Perform a Portfolio Analysis

Take a holistic approach to your investment portfolio and consider how crowd funding fits into your overall investment strategy.

Assess the diversification of your portfolio and evaluate the potential impact of crowd funding investments on your risk and return profile. Aim for a balanced and diversified portfolio to minimize risk exposure.

Stay Informed and Engage

Actively engage in the crowd funding community to stay informed about industry trends, market updates, and investment opportunities.

Join forums, attend webinars, and participate in online communities dedicated to real estate crowd funding. Networking with other investors and industry experts can provide valuable insights and expand your knowledge base.

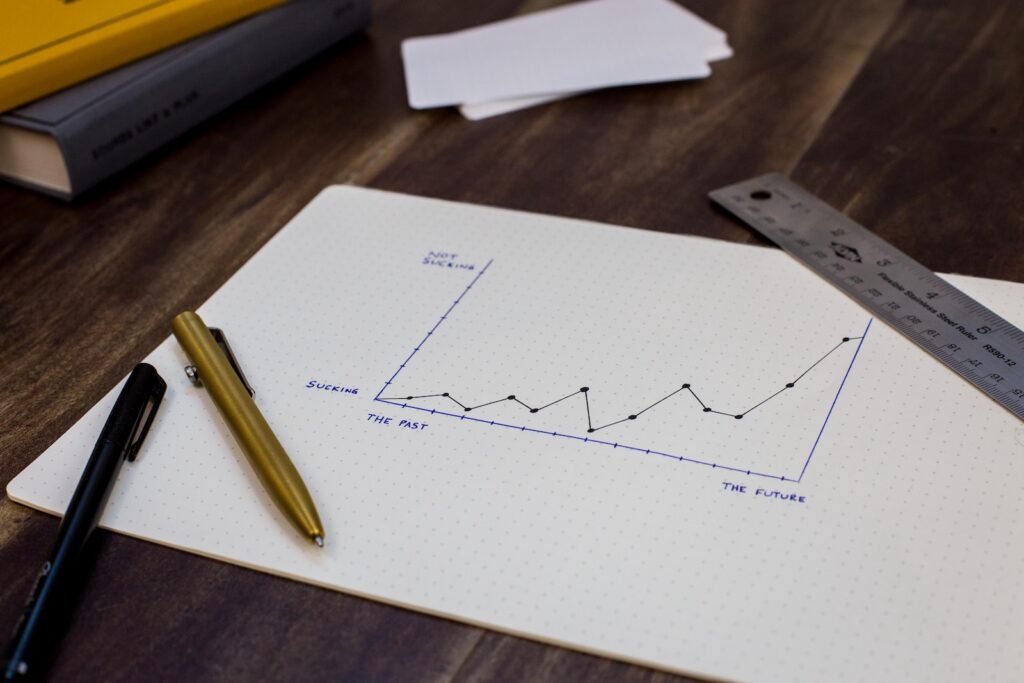

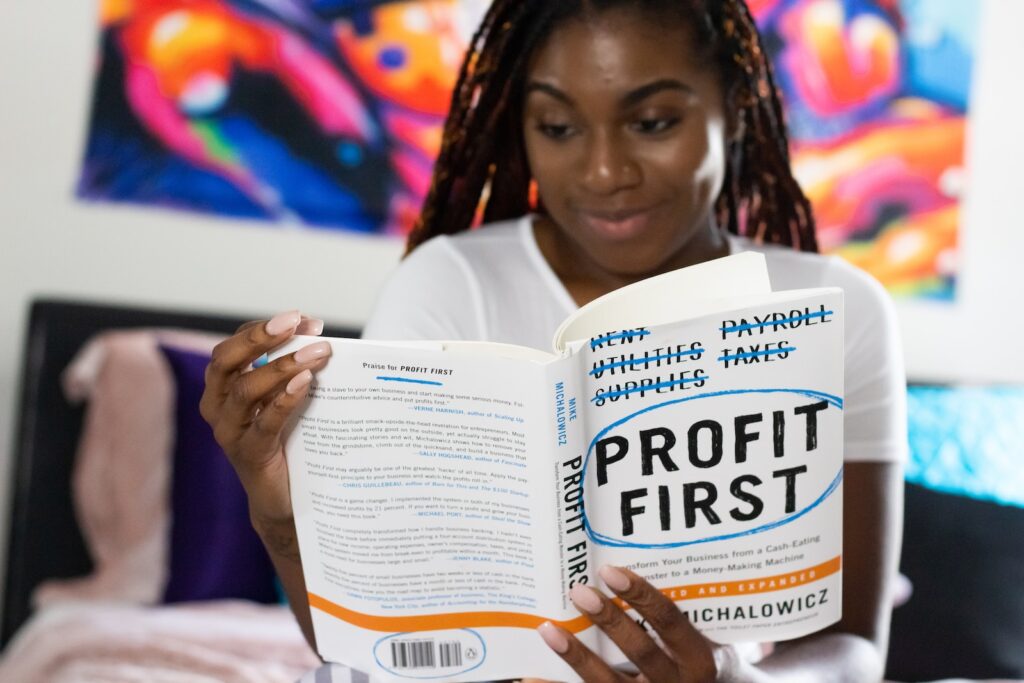

Continuously Educate Yourself

Investing in your financial literacy is key to long-term success in crowd funding. Stay updated on industry news, regulatory changes, and best practices by attending educational events, reading relevant publications, and following reputable blogs and podcasts. Continuously educate yourself to refine your investment strategies and adapt to evolving market conditions.

Tips for Efficiently Completing the Checklist

Here are some practical tips to help you efficiently complete the crowd funding investor education checklist:

- Allocate dedicated time for research and due diligence to make informed decisions.

- Create a structured checklist or spreadsheet to track your progress and organize key information.

- Take detailed notes during your due diligence process to compare and evaluate different investment opportunities effectively.

- Engage with experienced investors and industry professionals to gain insights and learn from their experiences.

- Regularly review and update your investment portfolio to ensure it aligns with your goals and risk tolerance.

- Stay proactive and monitor your crowd funding investments regularly to stay informed about project updates and potential risks.

The Benefits of Using the Checklist

By using this crowd funding investor education checklist, you can enjoy several benefits:

- Structured Approach: The checklist provides a structured framework to guide you through the complex crowd funding process, ensuring you don’t overlook crucial steps.

- Confidence and Informed Decisions: Following the checklist empowers you to make informed investment decisions based on thorough research and due diligence, increasing your confidence as an investor.

- Risk Mitigation: The checklist emphasizes assessing investor protection measures, understanding deal structures, and reviewing terms and conditions, reducing potential risks associated with crowd funding investments.

- Optimized Returns: By following the checklist, you can identify investment opportunities aligned with your goals, optimize your portfolio diversification, and enhance the potential for favorable returns.

- Continuous Learning: The checklist encourages continuous education and engagement within the crowd funding community, allowing you to stay updated on industry trends, regulatory changes, and investment strategies.

Examples: How Crowd Funding Enhances Real Estate Investment?

Let’s explore a couple of examples that demonstrate the power of crowd funding in real estate investment:

- Example 1: Access to Diverse Investment Opportunities

- Crowd funding platforms provide access to a wide range of real estate investment opportunities that may otherwise be inaccessible to individual investors.

You can invest in various property types, including residential, commercial, or mixed-use developments, as well as different geographic locations. This diversification potential allows you to spread your investment across multiple projects and markets, reducing concentration risk.

- Example 2: Mitigating Barriers to Entry

- Crowd funding eliminates some of the traditional barriers to entry in real estate investment. In the past, investing in real estate required substantial capital, extensive networks, and specialized knowledge.

However, crowd funding platforms enable investors to participate in projects with lower minimum investment amounts. Additionally, the platforms provide a streamlined process, making real estate investment more accessible to a broader range of individuals.

Unlock Real Estate Investment Opportunities

As a private lender or real estate investor, enhancing your financial literacy through crowd funding is a powerful step towards unlocking new investment opportunities in the real estate market. By following this comprehensive crowd funding investor education checklist, you will develop a structured approach, make informed decisions, and mitigate potential risks.

Remember to evaluate your investment goals, research reputable crowd funding platforms, analyze investment opportunities, perform due diligence, and understand deal structures and terms. Engage with the crowd funding community, continuously educate yourself, and regularly review your portfolio to optimize your real estate investment journey.

Now that you have the tools and knowledge, it’s time to take action. Begin exploring crowd funding platforms, assessing investment opportunities, and building a diversified real estate portfolio. Embrace the benefits of crowd funding, including access to diverse investments, risk mitigation, and continuous learning. Start your journey towards financial growth and success in the real estate market.