Building Trust and Rapport in Debt Collection: Key Skills for Private Lenders

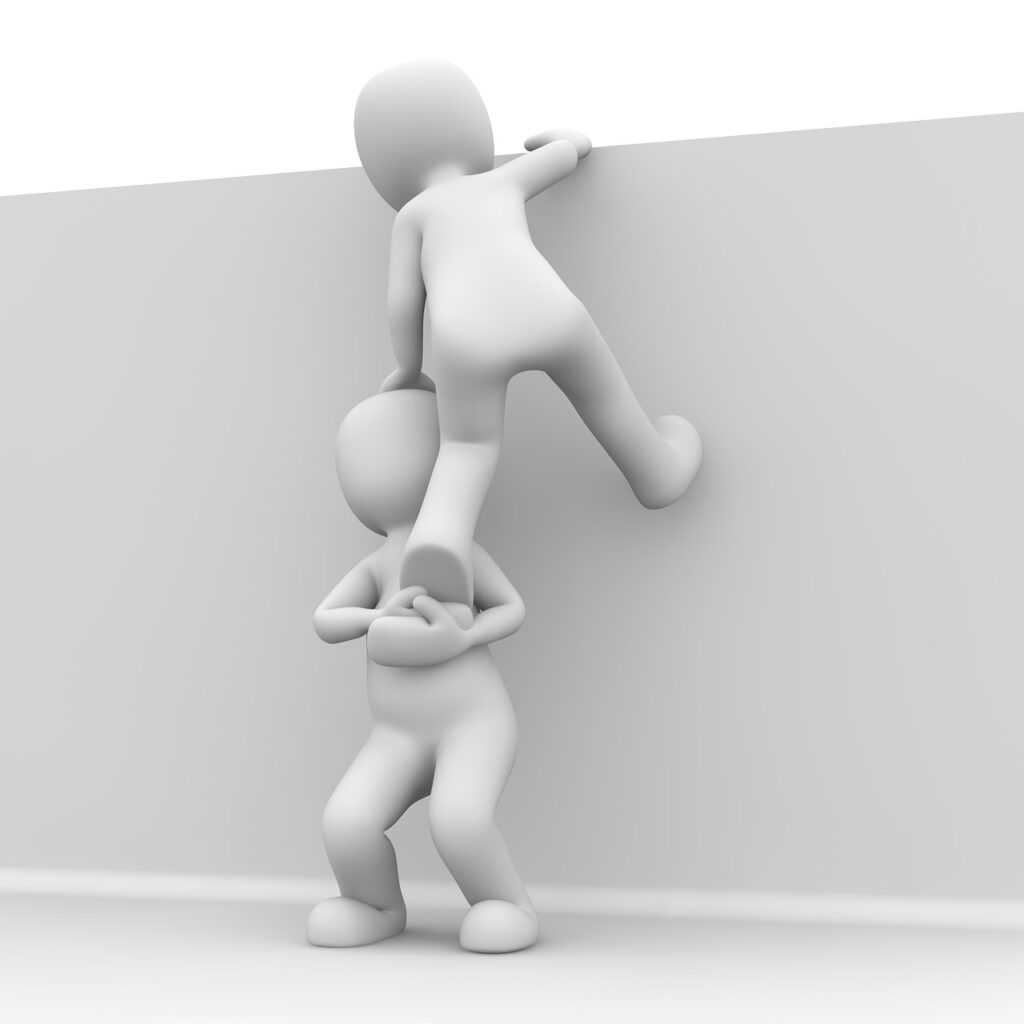

When it comes to debt collection, it’s not just about the numbers. Building trust and rapport with borrowers is the key to successful recovery. By understanding their perspective, communicating effectively, and offering flexible solutions, you can establish a strong foundation for productive interactions. Our guide will provide you with practical tips and tricks to implement in your debt collection process.

Through empathy, active listening, and professionalism, you can navigate the challenges of debt collection while maintaining a respectful relationship with borrowers. We will also discuss the importance of documentation, seeking legal counsel when necessary, and fostering transparency and trust.

By incorporating these skills into your practices, you can enhance your reputation as a trusted private lender and achieve better debt collection results.

Quick Tips and Tricks for Building Trust and Rapport:

Understanding Your Borrowers’ Perspective

One of the most crucial aspects of building trust and rapport in debt collection is understanding your borrowers’ perspective. Put yourself in their shoes and consider their circumstances. Recognize that they may be facing financial challenges or unexpected difficulties.

By approaching debt collection with empathy and understanding, you create a foundation for open and constructive communication.

Effective Communication: Clear, Concise, and Professional

Clear and professional communication is vital in debt collection. Ensure that your messages are concise, courteous, and easy to understand.

Clearly state the amount owed, due dates, and any consequences of non-payment. Avoid using complicated legal jargon that may confuse borrowers. Instead, use plain language and provide them with all the necessary information they need to fulfill their obligations.

Active Listening: Hearing and Acknowledging Borrowers’ Concerns

Active listening is a powerful skill that helps build trust and rapport. Give borrowers the space to express their concerns, frustrations, or difficulties.

Show genuine interest in their perspective by paying attention, summarizing their concerns, and offering potential solutions. This approach demonstrates that you value their input and are committed to finding mutually beneficial resolutions.

Offering Flexible Payment Options

To strengthen the relationship with borrowers, consider providing flexible payment options whenever possible. Understand that some borrowers may be facing temporary financial setbacks.

By offering alternatives such as payment plans or temporary forbearance, you show empathy and a willingness to accommodate their needs. Make sure to document any arrangements agreed upon by both parties for future reference.

Proactive Issue Resolution

Don’t wait for problems to escalate before taking action. Be proactive in addressing potential issues or changes in a borrower’s payment pattern. Reach out to borrowers if you notice any deviations from the agreed-upon terms.

By initiating early communication, you can gain a deeper understanding of their situation and work together towards finding viable solutions. Prompt action helps prevent misunderstandings and maintains trust.

Maintaining Professionalism and Respect

Regardless of the challenges that may arise during debt collection, it’s crucial to maintain professionalism and treat borrowers with respect. Avoid engaging in personal attacks or confrontations. Instead, focus on resolving the issue at hand in a courteous and respectful manner.

By handling debt collection with dignity, you not only preserve your reputation but also increase the likelihood of successful resolution.

Documenting and Organizing Interactions

Keeping accurate records of all communication and interactions with borrowers is essential in debt collection. Documenting conversations, agreements, and payment history ensures legal compliance and provides a reference for resolving any disputes that may arise. Implement a reliable system to organize these records for easy access when needed.

Seeking Legal Counsel When Necessary

If a debt collection issue becomes complex or disputes arise, seeking legal counsel is a prudent step. An experienced attorney can provide guidance on the best course of action while ensuring compliance with relevant laws and regulations.

This approach protects your rights and interests as a private lender, and it demonstrates your commitment to operating within legal boundaries.

Fostering Transparency and Trust

Transparency is a vital element in building trust with borrowers. Be open and honest about the debt collection process, including any fees, penalties, or potential legal actions.

Clearly communicate the consequences of non-payment and any available remedies. By fostering transparency, you help borrowers understand the importance of fulfilling their obligations and contribute to a more productive and respectful relationship.

Providing Resources and Support

As a private lender, you can differentiate yourself by offering resources and support to borrowers. Provide educational materials or workshops on financial literacy or debt management.

Recommend credit counseling services if appropriate. By showing a genuine interest in borrowers’ long-term financial well-being, you contribute to their success and enhance the likelihood of successful debt collection.

Examples of Building Trust and Rapport in Action

Let’s consider a scenario to illustrate how the key skills of building trust and rapport can be applied:

- Scenario:

- A borrower is experiencing financial difficulties and is unable to make their monthly payment on time.

- Action:

- Empathy: Understand the borrower’s situation and acknowledge their challenges.

- Active Listening: Allow the borrower to express their concerns and offer a listening ear.

- Flexibility: Propose alternative payment options, such as a temporary reduction in monthly installments or a deferment.

- Documentation: Document the agreed-upon arrangement and ensure both parties have a copy.

- Follow-Up: Regularly communicate with the borrower to monitor progress and address any additional concerns.

Benefits of Implementing These Skills

Implementing these skills for building trust and rapport in debt collection can yield several benefits:

- Increased likelihood of timely payments from borrowers

- Reduced conflicts and disputes

- Improved communication and understanding between parties

- Enhanced reputation as a trusted and professional private lender

- Greater chances of successful debt collection outcomes

Resources and Tools to Support Your Efforts

Here are some resources and tools that can assist you in implementing these skills:

- Debt collection software: Utilize specialized software to track and manage debt collection activities, record interactions, and automate reminders.

- Financial literacy resources: Share educational materials or recommend reputable financial literacy programs that can help borrowers improve their financial management skills.

- Legal resources: Consult legal professionals, attend industry seminars or workshops, and stay updated on relevant laws and regulations to ensure compliance and informed decision-making.

Share Your Own Tips and Tricks

We would love to hear about your own experiences and any additional tips or strategies you’ve found effective in building trust and rapport with borrowers. Share your insights in the comments section below and contribute to the collective knowledge of our community.

Challenge: How Will You Improve Your Debt Collection Process?

Reflect on the skills and strategies shared in this article and consider how you can implement them in your debt collection process. What steps will you take to foster trust, improve communication, and achieve better debt collection outcomes? Share your thoughts and plans for improvement with us.